This is part one of an email miniseries expanding on Baretz+Brunelle’s Where Will the Work Go? futurecast. If you have time to watch the whole thing, catch the video replay here. If you don’t, this summary is a 3-minute read.

The B+B New Law Team can help you identify opportunities throughout your firm and build the kinds of legal service delivery models that clients are looking for.

Just as lawyers are not immune from COVID-19, law firms are not immune from the economic effects of the pandemic. Law firm leaders know this, of course, and immediately implemented cash-saving measures such as furloughs. The partners and associates that remain have cause to question if demand for their firm’s services will continue in our present business climate. They are wondering, worriedly: Where Will the Work Go?

That’s the title of a recent futurecast from Brad Blickstein, co-head of the NewLaw practice at Baretz+Brunelle. Brad’s answer is a hopeful one for traditional law firms – although, like everything else in 2020, it’s more complex than it would have been just a few years ago. He describes what could be called a bad news/good news/bad news/good news scenario facing law firms. But it’s one that could, ultimately, offer rich and lasting rewards for firms willing to innovate.

Let’s break it down.

THE BAD NEWS, PART I:

Faced with the uncertainty of a pandemic, businesses want to conserve cash. That means, in turn, that they want to cut their legal spending, and their preferred method of doing that is bringing work in house. For legal departments, it’s a simple proposition. Even with competitive salaries and benefits, hiring a full-time lawyer costs less that renting one by the hour.

This explains the dramatic numbers since 1997. From that year to 2016, according to the Bureau of Labor Statistics, the number of in-house lawyers has tripled, while headcount at law firms has increased by just 27%. At this point, 63% of law firms acknowledge that they are losing business to their own clients, per the Altman Weil Law Firms in Transition Survey. If that were the end of the story, it would not augur well for law firms. But it isn’t, because . . .

THE GOOD NEWS, PART I:

. . . corporate legal departments can’t run their preferred playbook in an economic downturn. While the number of in-house lawyers has ticked upward nearly every year since 1997, there are two notable exceptions to the trend: 2001, when the dot-com bubble burst, and a multiyear period coinciding with the Great Recession. It’s hard to hire lawyers, Brad notes, when a company is laying off workers on the assembly line.

In the current downcycle, then, the biggest competitor for every law firm – its own clients – can’t grow. And still, their everyday work must be performed. This work, Brad explains, includes employment litigation, regulatory and compliance matters, contract negotiation, intellectual property management and enforcement, real estate, and entity management. In past recessions, such work has gone out to law firms, only to get gradually clawed back. That would be a boon to law firms now, except that . . .

THE BAD NEWS, PART II:

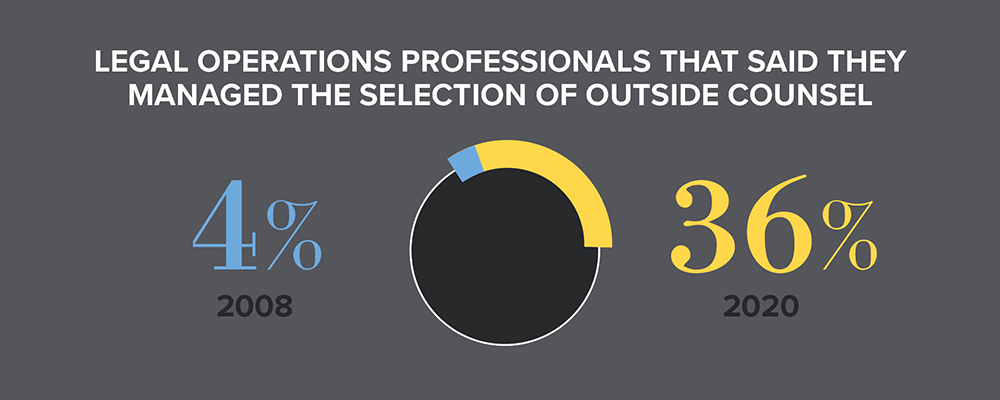

. . . this time, legal departments have more ways than ever of getting their everyday work done—many that don’t involve law firms. For a great many tasks, they can send the work to an alternative legal services provider, send it to an offshore legal process outsourcer, build a self-service model, or automate. In the Great Recession, some of these options existed, but they have flourished as legal departments have professionalized their buying practices, often embodied in legal operations professionals. In 2008, when Brad conducted his first annual Legal Department Operations Survey, only 4% of legal operations professionals said they managed the selection of outside counsel; by 2020, that figure was up to 36%.

This trend, and the fact that law firms are no longer the only outside partner in town, should make them sweat. But they have something important working in their favor, namely that . . .

THE GOOD NEWS, PART II:

. . . in-house counsel prefer to work with their law firm partners. Those firms are still their trusted advisors, with whom they have close relationships. And while law firms are no longer the automatic outside choice, they are in the pole position because they alone have the ability to combine the process innovations of ALSPs with all the benefits that accompany law firm relationships, which range from strategic insights to golfing buddies. Law firms can win new business by providing the cost-saving innovations clients want: creative pricing, improved project management, better use of technology, and client-facing digital services.

If they do, they’ll resolve the tension that general counsel feel between sending work where they want to, and where cost pressures demand. They will also recapture work they haven’t had for decades – and keep it.

And they may never have to wonder again: Where Will the Work Go?